UK furthers transparency of multinational corporations

by the Financial Transparency Coalition

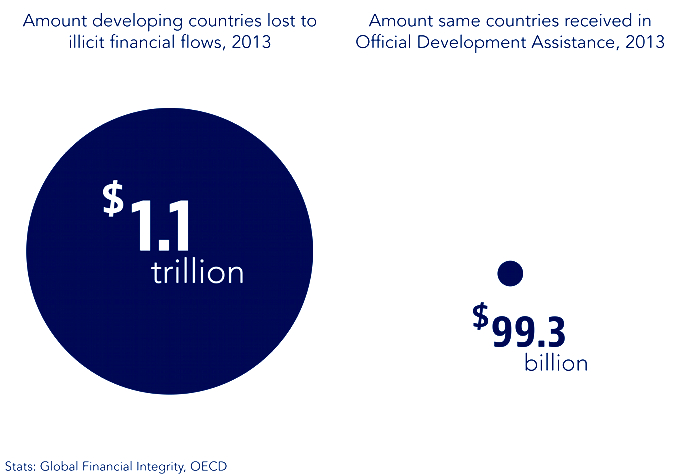

On Monday, the UK government agreed to an amendment to the Finance Bill that would enable the UK tax authority, HMRC, to publish country by country financial reports of UK-headquartered multinational corporations. Country by country reports show basic information about a multinational’s operations, including taxes paid, number of employees, revenue generated, and profits on a country-level. These reports can give light to abuse of tax laws and aggressive tax avoidance.

Porter McConnell, Director of the Financial Transparency Coalition, issued the following statement:

This step by the UK is certainly welcome, but it’s important that the government actually uses the power it now has by releasing country by country reports of UK multinationals to the public as quickly as possible. Last week, we saw outrage regarding Apple’s tax scheme in Ireland. Before that, there was outrage around secret tax deals arranged between Luxembourg and hundreds of corporations from around the globe. It’s time to break out of perpetual scandal mode and make some changes to business as usual. A financial system that relies on plausible deniability and shifting responsibility is inherently shaky, and it’s simply not sustainable.

But UK-headquartered corporations only represent a small portion of the global economy. This move should be a catalyst for other governments, a number of whom supported the idea of public country by country reporting in May’s Anti-Corruption Summit held in London. Members of the European Union will debate making country by country reports public in the coming months. To put the world economy back on sounder footing, more countries will need to join the UK and take up this common sense public reporting.

~ ~ ~

These announcements are interactive. Click on them for more information.