A new property tax scheme: not so much doomed to failure as born of failure

by Eric Jackson

First things first. In just a few weeks, at the beginning of 2019, a new property tax scheme goes into effect.

-

The old tax breaks on new construction, which have been the subjects of tinkering over the years are to be abolished but grandfathered in. If you got a 20-year, or 10-year, or five-year exoneration for new construction you will keep it. There just won’t be any more new exemptions of this type under the new plan.

-

It’s all designed for social classes that are not most Panamanians. Most people here don’t have bank accounts, let alone mortgages. But under the new scheme, banks that hold mortgages collect the property taxes by blending them into house payments. Will this morph into some requirement that a bank becomes a mandatory part of anyone owning a house over a certain value? We shall see, as both government action and the private practices of a monopolistic and politically powerful banking industry may determine that question.

-

For a “first home” — and how they intend to verify that ought to be interesting — there will be a three-year exemption up to a value of $300,000. It doesn’t matter if the home is new or used.

-

For a principal residence, there will be a property tax exemption for the first $120,000 of value.

-

For a second residence, or any other real estate holding, there is a total of $30,000 in exemptions. Let the lawyers and tax collectors argue about how that might be structured or counted.

-

The old breaks, and the one percent of the property’s value rate, might be maintained but to take advantage of the new breaks the old ones will have to be renounced and the real estate will have to be registered as “family property.” It will apparently not matter for this purpose if the asset is kept in the name of a corporation or foundation. “Family” is loosely defined — not as in the Family Code. It doesn’t matter for this purpose if the people in the household are citizens or foreigners, or if they are possessed of a marriage license. There will be lawyer and accountant work here.

Nobody is really up in arms, as has been the case with previous attempts to reform property taxes. Rather than squeezing out more money or shifting burdens, this time it seems to be a simple recognition of realities on the ground. Hard, sad realities.

As in, for example, new building permits for the first nine months of 2018 down 49 percent from the same period in 2017. As in all these empty condo towers on the beaches. As in wonderfully productive and beautiful farms along rivers through the hills, and houses near beaches with all the conveniences, just not selling no matter how low the price gets knocked down. As in an economy still growing on paper, largely on the strength of financial transactions on paper, but brutally slow if you look at the production or sale of actual things, with small partial rebounds from catastrophic drops of yesteryear counted as much of the growth. As in a government going deeper and deeper into debt for public works contracts to keep some Panamanians working and provide something for the self-entitled to skim. As in an election approaching in May, so an administration with forlorn hopes of retaining the Palacio de las Garzas and legislators staring at a ‘vote ALL the bastards out’ public mood, so politicians are unwilling to add material pain to the moral outrage of the moment.

Construction and real estate interests are political and media powers, so certain things are left unsaid. Like investments in low-lying areas menaced by rising sea levels.

And understand that political demagoguery has left some fairly salient features of the real estate scene studiously ignored. Like how the crackdowns on immigration from Venezuela in particular, and on the “permanent tourists” and in effect also a lot of snowbirds, have dried up the market for upscale condos. Like how an international outcry that’s not just about The Panama Papers makes investments in this country’s money laundering towers more suspect here and abroad. Supply and demand don’t function in high-end Panamanian real estate, there are all these empty properties.

So the long-running phaseout of tax breaks for new upscale housing units gets more acute? No big deal. There isn’t a lot of that business lately anyway. Nor are the adjustments to how property taxes are collected and how much will be taxed going to drastically affect many people.

The likely winners? Lawyers and CPAs getting paid to interpret and navigate the changes for their clients. Banks that are likely to add a fee for their tax collection services. Perhaps the government, with a more stable collection system if not with a big windfall.

The likely losers have generally already eaten or factored in their losses.

~ ~ ~

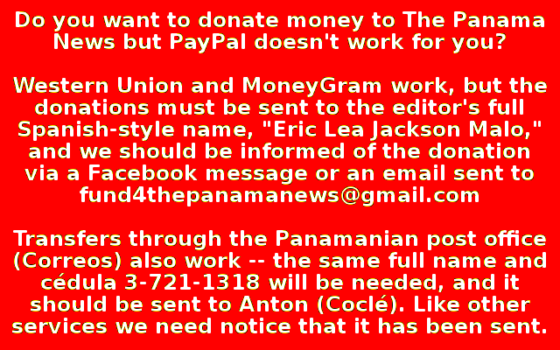

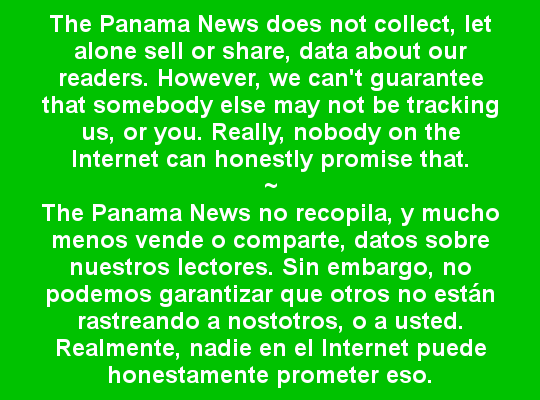

These announcements are interactive. Click on them for more information.