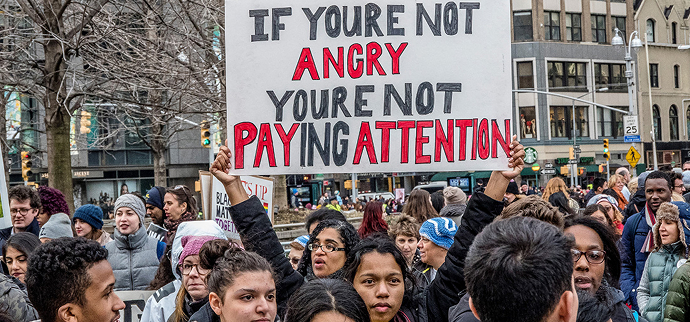

Code Pink takes to the streets of Washington, along with many other women, in 2019. Photo by Fred Murphy.

IMF calls for taxing world’s richest to

curb inequality, stave off social unrest

by Kenny Stancil — Common Dreams

f governments don’t close the gap between society’s richest and poorest members—which was growing before and has exploded during the coronavirus crisis—by raising wages for low-income workers, taxing wealthy households, and using the increased revenue to improve social welfare, they should expect diminished trust in government and increased social polarization and unrest.

That warning comes in a new report on the intensification of inequality released Thursday by the International Monetary Fund (IMF), a Washington D.C.-based international financial institution whose lending policies prior to and even during the Covid-19 pandemic have heightened vulnerability to crises by imposing public expenditure cuts in developing countries.

The IMF noted that the coronavirus disaster laid bare preexisting inequalities within and between countries in terms of income and access to public goods, such as healthcare and vaccines. Such “inequalities have worsened the effect of the Covid-19 pandemic,” with a strong link between poverty, unequal access to basic services, and infection and mortality rates.

While preexisting inequalities have worsened health outcomes for vulnerable populations, the coronavirus-driven economic crisis has, in turn, exacerbated inequality. For instance, 95 million more people were thrown into extreme poverty during 2020 than would have been expected based on pre-pandemic projections, and unequal access to quality education and digital infrastructure “may cause income gaps to persist generation after generation.”

According to the IMF: “Disruptions to education threaten social mobility by leaving long-lasting effects on children and youth, especially those from poorer households. These challenges are being compounded by accelerated digitalization and the transformational effect of the pandemic on the economy, posing low-skilled workers with difficulties in finding employment.”

It is “against this backdrop,” the IMF added, that “societies may experience rising polarization, erosion of trust in government, or social unrest. These factors complicate sound economic policymaking and pose risks to macroeconomic stability and the functioning of society.”

Reducing inequality “is crucial for policymakers to strengthen public trust and support social cohesion,” the IMF stressed. “Governments need to provide everyone with a fair shot—enabling all individuals to reach their potential.”

“The pandemic has confirmed the merits of equal access to basic services—healthcare, quality education, and digital infrastructure—and of inclusive labor markets and effective social safety nets,” the IMF noted. “Better performance in these areas has enhanced resilience to the pandemic and is key for the economic recovery to benefit all and to strengthen trust in government.”

“In the months ahead,” the IMF said, universal access to inoculation “will be decisive.”

While “cross-country surveys administered before the pandemic suggest that respondents in advanced and emerging market economies have long expressed favor for more tax-financed spending on education, healthcare, and old-age care, and more progressive taxation,” the IMF wrote that “popular support for better public services… has likely risen” in the past year due to increased “attention on governments and their ability to respond to the crisis.”

“Public finances have been weakened in most countries as a result of the pandemic,” but the IMF said that “many countries will need to raise additional revenues and improve spending efficiency… to support inclusive growth in a context of tighter fiscal space.”

Policymakers, the IMF added, “should recognize that various aspects of inequality (income, wealth, opportunity) are mutually reinforcing and create a vicious circle.”

Policy interventions should therefore combine “predistributive” policies that affect incomes before taxes and transfers, such as increasing employment and wages, as well as redistributive policies, such as taxing the rich to expand and improve the provision of public goods.

The IMF made the following recommendations:

- Investing more and investing better in education, health, and early childhood development;

- Strengthening social safety nets by expanding coverage of the most vulnerable households, and increasing adequacy of benefits;

- Mustering the necessary revenues. Advanced economies can increase progressivity of income taxation and increase reliance on inheritance/gift taxes and property taxation. Covid-19 recovery contributions and “excess” corporate profits taxes could be considered. Wealth taxes can also be considered if the previous measures are not enough. Emerging market and developing economies should focus on strengthening tax capacity to finance more social spending;

- Acting in a transparent manner. For most countries, these reforms would be best anchored in a medium-term fiscal framework as early as possible. Strengthening public financial management and improving transparency and accountability, not least for Covid-19 response measures, will reinforce trust in government; and

- Supporting lower-income countries that face especially daunting challenges. Meeting the Sustainable Development Goals—a broad measure of the access to basic services—by 2030 would require $3 trillion for 121 emerging market economies and low-income developing countries (2.6% of 2030 world GDP). Support from the international community is needed to aid reform efforts, with the immediate priority being affordable access to vaccines.

The IMF’s report coincides with another analysis out Thursday, which revealed that the world’s 2,365 billionaires have seen their collective fortunes grow by $4 trillion during the pandemic, a staggering windfall that prompted demands for a global wealth tax.

“Unless we tax the world’s billionaires,” warned Chuck Collins, researcher with the Program on Inequality at the Institute for Policy Studies, “the legacy of the pandemic will be accelerated concentrations of wealth and power.”

Contact us by email at fund4thepanamanews@gmail.com

To fend off hackers, organized trolls and other online vandalism, our website comments feature is switched off. Instead, come to our Facebook page to join in the discussion.

These links are interactive — click on the boxes