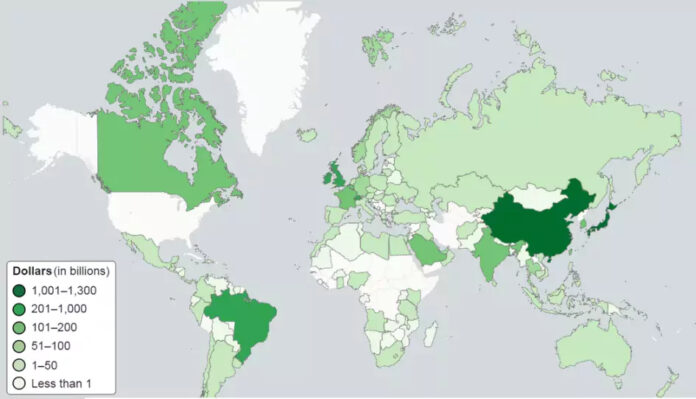

Who holds US government treasury bonds? Graphic by the US Government Accountability Office.

Let’s end the false debate over the debt limit

by Joseph Stiglitz

The current threat of default on the United States debt is built on an absurdity, almost a kind of mathematical error. While the public debate has inevitably centered around the level of government spending, the debt ceiling has nothing to do with that. Expanding the debt limit is not a conversation about future expenditure, but about meeting the level of spending Congress has already passed. If you pass a law that expenditures should be X dollars and taxes Y dollars, then the deficit will be X minus Y. You can’t change that, and a third law contradicting the first two makes no sense.

If Congress passes expenditure bills that sufficiently exceed the revenue bills enacted, the administration can’t comply simultaneously with all three—that is, with the expenditure bills, the tax bill, and the debt ceiling. It has the responsibility of interpreting which is overriding, and here the inviolability of the debt and other obligations is the overriding principle. Conservatives in Congress using the debt ceiling as a political tool are putting our economy at severe risk. It’s our responsibility, and within our power, to rein in this behavior, and to debate fiscal policy on its merits.

The economic cost of the US debt impasse is stark, and repeated near-default threats have the potential to seriously undermine confidence in the US ability to pay its debts. The way financial markets function makes this level of confidence as important a metric as the level of debt itself. Bond rates may spike, and stock market volatility will increase. Consumers and firms will face higher interest rates and reduced credit availability, exacerbating the effects we’re already seeing from the Fed’s rate hikes.

All of these effects, combined with the resulting increase in economic uncertainty, will inevitably erode the overall economic health of the country; indeed, a failure to increase the debt limit risks bringing about a recession. Credible public- and private-sector estimates find that a short default could cost half a million jobs in 2023, with a longer default ending in 8.3 million jobs lost and unemployment going up five full percentage points. A short default would reverse the important gains we’ve made in the labor market, where we are transitioning to steady, strong growth with unemployment at the lowest levels it’s been in over 50 years, including the lowest on record for Black Americans.

The higher interest rate combined with lower economic growth will worsen the deficit: Tax revenues will decline, and debt service expenditures will increase, just the opposite of the stated objective of those currently holding government hostage.

In our democracy, we have three fundamental ways of dealing with excessive deficits. We can democratically, through Congress, approve tax increases—such as a windfall profits tax on corporations that have made off like bandits during the pandemic and the war in Ukraine while many Americans suffered, partly because of the high prices that firms with market power can charge. Or we can democratically approve expenditure decreases through Congress, both now and in the future. If Congress wants to reduce Social Security or curtail Medicare or eviscerate our education, infrastructure, environmental, and technology programs, it can do that; we have constitutional processes, requiring assent by the executive branch, with an override by Congress of any veto.

Finally, we have elections. Obviously, I wish there were less voter suppression, less gerrymandering, a stronger relationship between “the will of the people” and election outcomes. Still, there is some accountability: If the electorate is dissatisfied with either side of the equation, either with expenditures or taxes, they can reflect that dissatisfaction in their voting.

But one thing neither Congress nor voting can change is arithmetic—the reality that deficits are the simple difference between expenditures and taxes, and debt is nothing but the accumulation of deficits and surpluses.

A moment of reckoning

This should be a moment of reckoning for those who falsely promised that tax cuts for the wealthy during the Reagan, Bush, and Trump administrations would generate revenue. Their failure to do so was predictable and predicted. But if that crowd really believes the deficit is too large, they should either reverse the tax cuts, or specify which major government program—Social Security or Medicare or both—they want to cut. Nibbling around the edges, nickel and diming one agency or another, may be good for grandstanding, but will do little to achieve what they claim they want. And cutting support for the IRS, so that it collects less taxes, will also be counterproductive.

Our democracy can’t function without a modicum of honesty, and honesty requires us to admit we can’t repeal the laws of arithmetic—not even the legislature in the most powerful country in the world can do that. Let’s have an honest debate about taxes and expenditure, recognizing that our deficit and debt just follow from those decisions.

Contact us by email at fund4thepanamanews@gmail.com

To fend off hackers, organized trolls and other online vandalism, our website comments feature is switched off. Instead, come to our Facebook page to join in the discussion.

These links are interactive — click on the boxes