The falling out — looking for motives

by Eric Jackson

In just about any crisis, prudent investors move to cut their losses, opportunists move to squeeze advantage and conspiracy theorists move to promote coincidences real or imaginary into central facts. Motives can be awfully hard to prove and the background noise can make events difficult to follow. For instance, the Citi card. On March 10 that institution pulled out of a $625 bond issue for Tocumen Airport, alleging that circumstances were not as they agreed. So, a nefarious plot to trash Panama? On March 12 Citi agreed to buy the bonds after all, but at a more favorable to itself interest rate. So maybe it was just a business move in light of a riskier climate.

Balboa Bank & Trust is one of the institutions first banned by its inclusion on the US Treasury Department’s “Clinton List” of money launderers, then seized by Panama’s banking superintendent. The Securities Market Superintendency likewise intervened to take over Balboa Securities, the stock brokerage branch of this bank. These actions were taken due to allegations linking the institutions to the “Waked Money Laundering Organization.” Panamanian corporate secrecy keeps us from knowing just who owns just what, but it is alleged and commonly believed that the Waked family owns controlling stakes in these institutions. But as to the bank, there are some gaps in the veil of Panamanian secrecy.

First of all, the current owners of Balboa Bank & Trust, a corporation known as Strategic Investments Group, were chosen by the US government. That institution used to be the Panama branch of Stanford Bank and in the US move to shut down that operation the sale to the Waked-dominated group was negotiated by a US federal court appointed receiver, Ralph Janvey, and approved by US District Judge David Godbey. That deal was struck after — based on some undisclosed information from an undisclosed source, but we might easily guess — a well advanced process to award the bank to a group of investors led by former HSBC Panama branch executive Joe Salterio was vetoed. So in a sense, just like the US relationships with Manuel Antonio Noriega, Osama bin Laden, Colombia’s AUC paramilitary — and according to some allegations, now imprisoned ponzi scheme operator Allen Stanford — this was a falling out among people who had at one point worked together.

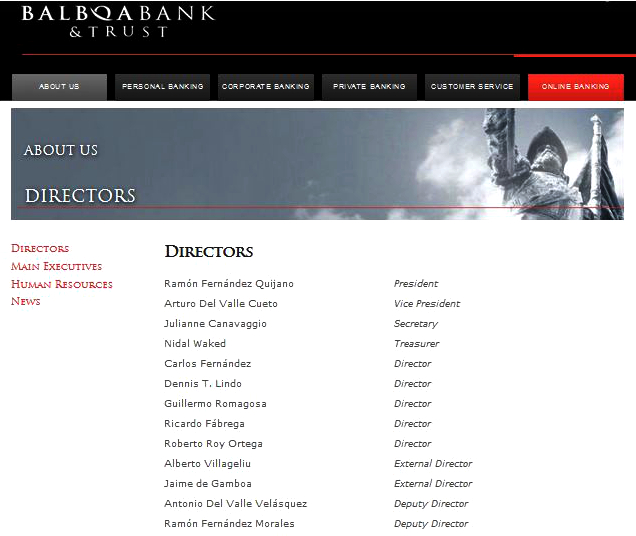

But who else? Does Panama live up to its reputation as a place where family means everything? Look at the board of directors of Balboa Bank & Trust and you the Quinano and Roy families represented. As in, relatives of the Panama Canal administrator Jorge Luis Quijano and of Minister of Canal Affairs Roberto Roy. Families with various stakes in the Panama Canal expansion are also represented on that board.

The suggestion that “you’re guilty because you’re related to ___, who is associated with ___” is obnoxious. But the Wakeds are not the only family affected by the US moves against those nearly 70 businesses (and indirectly others). Nor are the Mossacks and Fonsecas the only lawyers affected by the international furor over the Panama Papers revelations. Is the problem that Washington perceives not about one family but about Panama? This appears to be the case. But if it is about Panama in general, then the question of why the Americans moved against this group of businesses, about which they have known for years, at this particular time probably becomes important. It may at some point be an easy one to answer in retrospect, but at this point there are only shreds of evidence on which to draw inferences.

~ ~ ~

These announcements are interactive. Click on them for more information.